On September 10th, the 2022 International Symposium on Macroeconomics and Fintech Frontiers, organized by the China Academy of Financial Research and hosted by Zhejiang University of Finance and Economics (ZUFE), was held at ZUFE. Experts and scholars from colleges and universities attended this symposium including the University of Notre Dame, Xi’an Jiaotong-Liverpool University, Tianjin University, Carleton University, the University of Manitoba, Hunan University, Macquarie University, and ZUFE. Huang Wenli, Executive Dean of the China Academy of Financial Research of ZUFE, and Lu Lei, a professor from the University of Manitoba were the co-chairmen of this Symposium.

Zhang Xiaohong, Dean of the China Academy of Financial Research of ZUFE, delivered a speech. He said that China's economy had been facing big challenges against the backdrop of the global pandemic over the past three years. He hoped that this symposium could serve as a platform of communication and exchanges to propose suggestions and recommendations for China's economic development.

He Xuezhong, a professor from Xi'an Jiaotong-Liverpool University made a keynote speech themed "Quantitative Investing and Price Informativeness", in which he explained the relationship between the capital market price information and quantitative investing.

Da Zhi, a professor from the University of Notre Dame, delivered a keynote speech themed "All in A Day's Work: What Do We Learn from Analysts' Bloomberg Usage?" By describing the work habits of sell-side analysts with data about analysts' Bloomberg usage, the study found that working in a harder and smarter way could improve the accuracy of analysts' earnings forecasts.

Shi Jing, a professor from Macquarie University gave a keynote speech themed "A Good Sketch is Better than A Long Speech: Evaluate Delinquency Risk through Real-Time Video Analysis". By analyzing borrowers' facial micro-expressions, this study measured the impact and mechanism of default risk.

Xiong Xiong, a professor from the College of Management and Economics of Tianjin University, made a keynote speech with the theme of "Will Social Media Distort Price Discovery? Evidence from M&A Rumors". By analyzing news of mergers and acquisitions, he conducted further research on the impact of social media on the price discovery function of the financial market.

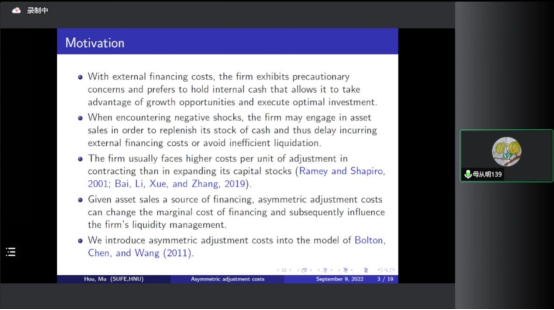

Mu Congming, a professor from the College of Finance and Statistics of Hunan University delivered a keynote speech themed "Dynamic Liquidity Management with Asymmetric Adjustment Costs", which analyzed the significance of dynamic liquidity management for enterprise financing against the backdrop of asymmetric adjustment costs.

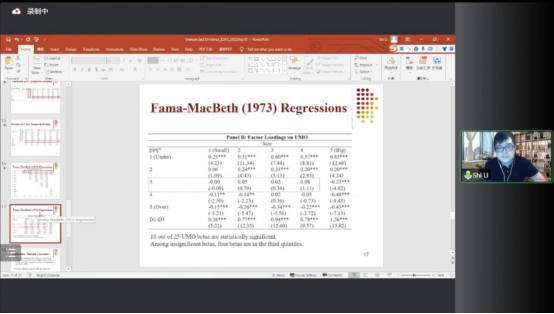

Li Shi, a professor from Carleton University gave a keynote speech themed "The Price of Unexpected Dividends", analyzing the impact of an unanticipated stock dividend on asset pricing and traditional factor model and giving a deeper understanding of dividends.

Xu Yueling of the China Academy of Financial Research of ZUFE made a keynote speech which was themed "A Study on the Impact of Institutional Shareholdings to Systematic Financial Risk Spillovers". By analyzing the impact of institutional shareholdings on systematic financial risks, she offered a new idea for China’s prevention and control of systematic financial risks.

Lu Lei, a professor from the University of Manitoba, delivered a keynote speech themed "Option-implied Firm-level Sentiment and Stock Returns". He built an option-implied firm-level sentiment index and studied the forecasting ability of this index.

This symposium was held both online and offline, attended by AUT 2019-2021 postgraduates, teachers, and students of the College of CAFR. With more than 2,500 participants, it attracted extensive attention from the financial academia at home and abroad.